Buying a New Home? What's Tax Deductible?

Yes, you’re taking on a big debt, but you may be eligible for income tax deductions and credits.

It’s probably the biggest expense you’ll ever have in your life: the purchase of a home. Unless you were fortunate enough to be able to buy it with cash, you’ll have to put some financing together. Some people get loans from family to cover the sale price, but it’s more likely that you’ll have to take out a mortgage for at least part of the cost.

There’s your first tax break, and one you probably know about: the home mortgage interest credit. There are others. Here’s a look at some of the credits and deductions that can chip away at your total financial commitment.

How Does The IRS Define a Home?

Broadly. A home can be a house, condominium, cooperative apartment, mobile home, houseboat, or house trailer that contains sleeping space, toilet, and cooking facilities.

What Is The Mortgage Interest Credit?

This is a tax credit you receive for paying interest on a loan you received to purchase your main home or a second home. It can be a first or second mortgage, refinanced mortgage, home equity loan, or home improvement loan. If you pay points, these may be partially deductible, but it’s complicated (we can help you determine this).

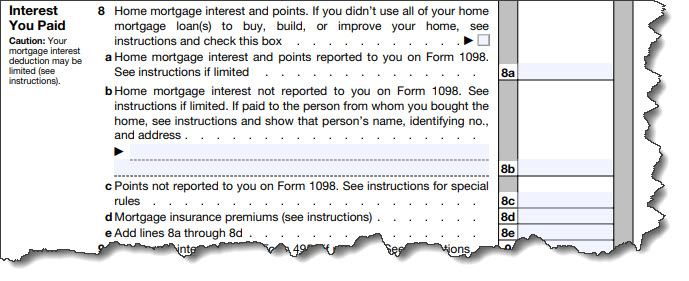

Mortgage interest is recorded on the IRS Form 1098 (which your lender will send you if you’ve paid more than $600 on mortgage interest and points in a tax year) and is eventually reported on the Schedule A: Itemized Deductions. So you must itemize in order to get the credit.

You should receive a mortgage interest statement from your lender if you pay more than $600 during the tax year. You’ll use this information to complete a Schedule A: Itemized Deductions, as pictured above.

Most often, you’ll be able to deduct all of your mortgage interest. But the IRS has limits for certain situations, like when the loan exceeds the home’s fair market value. We can walk you through the process of dealing with this and other exceptions.

Where Else Might Reduce Your Tax Liability?

If you pay real estate taxes on your home, these should be deductible on the Schedule A. Unless you purchase a home on January 1, you’ll be splitting the deduction for real estate taxes paid with the seller. The IRS has a special formula for calculating this Mortgage insurance premiums, too, are often deductible.

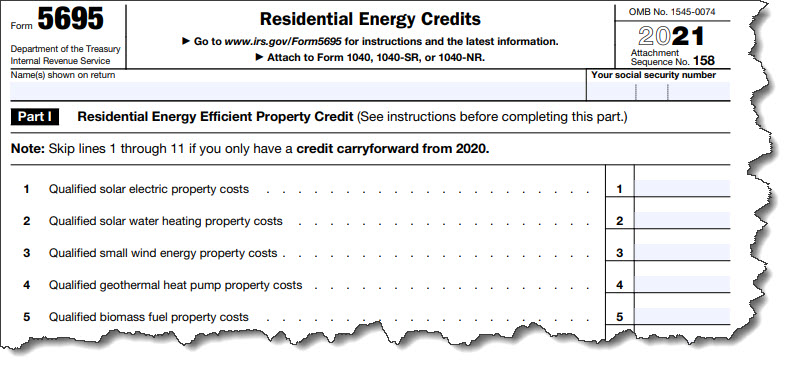

Thanks to the Inflation Reduction Act, there will be more tax credits available for upgrades that improve your home’s energy efficiency. The old Nonbusiness Energy Property Credit has been revived (it expired at the end of 2021) and renamed as the Energy Efficient Home Improvement Credit.

Under the old rules, you could deduct up to 10% of the cost of specific doors, windows, insulation, etc., and 100% of the cost of some home heating and cooling systems. But you could only claim up to $500 during your lifetime. There were also limits on individual items.

Starting with the 2023 tax year (2022 still goes by the old rules), the credit will be bumped up to 30% of eligible improvements. Limits for specific equipment will increase, and there’ll be a new $1,200 annual limit on the credit. This is all good, but confusing. We can help you make decisions based on this credit before you purchase.

Beginning with the 2023 tax year, the limits for residential energy credits will be increased, thanks to the new Energy Efficient Home Improvement Credit.

What’s Not Deductible?

Most costs associated with home ownership are not deductible on your income taxes, like insurance (except for mortgage insurance), settlement and closing costs, home repairs, and homeowners’ association fees. But you don’t want to miss out on anything that is deductible. We hope you’ll meet with us if you have any questions about the deductions and credits available for home owners.